Tesla Stock Forecast: Bullish or Bearish?

Like many other market-watchers, we have been following the ups and downs of the Tesla stock price. The electric car maker has been making headlines for months, especially since its quarterly results last month. The results were disastrous for investors, who sent prices of the stock diving. The stock price of Tesla is as volatile as its cars, although many consider Tesla one of the best stocks to buy now. It has swung from euphoric highs to crushing lows in less than a week. Is it a buy or a sell? Let’s find out.

What Happened to Tesla Stock?

The Tesla stock price plunged after the company reported its quarterly earnings on 6th of July. It was a disastrous quarter for Tesla, as revenue shrank and the company burned through more than $719 million in cash in the process. The negative figures prompted investors to trash the stock price, which saw a loss of $11.99 per share. This was a sharp drop from the $0.65 EPS that investors got to enjoy in the first quarter. In fact, the second quarter was not much better for the stock either. The company’s top management was at the receiving end of a lot of criticism for the disappointing results. CEO Elon Musk made a series of off-the-wall Tweets, one of which led him to be temporarily barred from the company’s official account. Tesla’s stock price was also pressured by the continuing concern over the company’s Model 3 production and sales. In fact, the Model 3 was selling at below the cost of a Chevy Malibu.

Tesla Stock Forecast

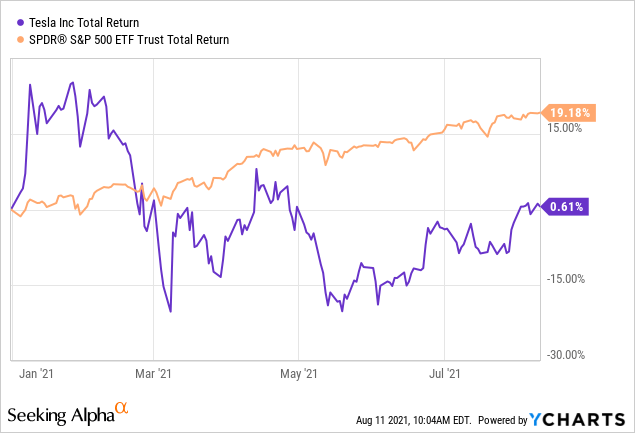

The Tesla stock outlook is currently bearish. The stock has been tumbling for the past month and has seen no signs of recovery. At the time of writing, the Tesla stock price is $118.67, which is down 8.59% since the beginning of the year. Investors are also keeping a close eye on the Model 3 program, as they hope that the company will be able to meet its production and delivery targets by the end of the year. However, analysts are not very optimistic about this. They believe that the company will be able to deliver only about 100,000 Model 3 cars by the end of the year. This might be a good number for Tesla, but it won’t be enough to spur the stock price.

Tesla Shortlist

Tesla has struggled to produce the Model 3 fast enough. New reports suggest that production at the Fremont factory is not tracking too well to the company’s plan. Tesla shortlists are also a concern for investors. The company has shortlisted investors to invest a billion dollars in Tesla. Tesla shareholders will vote on the shortlists in November. If approved, Tesla will be able to access the funds and gather resources to ramp up production. This could be another reason for the stock price to fall.

Bottomline

Tesla’s Q2 earnings results were not good. This was expected given the limited Model 3 production and sales. However, the stock price fell more than expected. The Model 3 was selling at below the cost of a Chevy Malibu and Tesla’s operational challenges were also reflected. Tesla’s production and sales targets are unrealistic. The company is also struggling to produce the Model 3 at the rate it wants. The stock price has fallen more than 20% since the beginning of the year. It is not a buy yet, but a sell is not a very good option either.

Read also: Amazon stock forecast for 2023