How to Gomyfinance.com Create Budget: A Step-by-Step Guide

Introduction to Budgeting

Gomyfinance.com Create Budget plays a fundamental role in managing personal finances effectively. It serves as a blueprint that lays out the short-term and long-term financial goals while providing a clear pathway to achieving them. Creating a budget allows individuals to track their income, expenses, and savings systematically, ensuring they have a clear understanding of their financial standing.

The primary importance of budgeting lies in its ability to promote financial stability. By regularly monitoring one’s cash flow, individuals can identify spending patterns and areas where money can be saved. This awareness helps in avoiding unnecessary debt, as individuals can make informed spending decisions that align with their financial objectives. Additionally, having a budget fosters discipline and accountability, making it easier to adhere to financial commitments and plans.

Furthermore, budgeting is essential for goal setting. Whether it’s saving for a vacation, purchasing a home, or preparing for retirement, a clearly outlined budget will identify the necessary steps required to attain these objectives. Through the use of tools such as gomyfinance.com create budget, individuals can simplify their budgeting process, enhancing their ability to manage funds accurately and efficiently.

Aside from supporting financial goals, budgeting can also help in mitigating financial stress. Knowing that there is a plan in place can ease anxiety related to managing day-to-day expenses. In light of its numerous benefits, understanding how to create a budget is pivotal for achieving financial well-being. As we delve deeper into the functionalities of gomyfinance.com, it will become evident how this platform serves as a practical solution in the budget creation process, further empowering individuals to take control of their financial futures.

Getting Started with gomyfinance.com

To embark on your budgeting journey, the first step is to sign up for an account on gomyfinance.com. The website’s user-friendly interface simplifies this process. Once you visit the site, the ‘Sign Up’ button is prominently displayed on the homepage. Clicking this will direct you to a registration form. Here, you will need to provide essential details such as your name, email address, and a secure password. After filling out the form, it is important to check your inbox for a verification email to activate your account.

Upon successful registration and account activation, you can log in to the platform. The dashboard will be your primary navigation hub. It provides an overview of your financial status, displays various budgeting tools, and offers insights into your spending habits. To help familiarize yourself with gomyfinance.com create budget features, the initial layout includes a sidebar that highlights different categories such as ‘Budgeting,’ ‘Expenses,’ and ‘Reports.’

As a new user, it is beneficial to explore the ‘Help’ or ‘Tutorials’ section available within the platform. These resources provide step-by-step guides on how to effectively utilize the site’s features. For instance, you can learn how to input your income, track your expenditures, and set financial goals using the budgeting tools provided. One tip for ease of navigation is to participate in any introductory walkthroughs that gomyfinance.com offers, which can greatly benefit your understanding of the overall budgeting process.

By taking these initial steps, users can set a solid foundation for utilizing gomyfinance.com to create and manage their budgets effectively. Engaging with these resources will empower you to make the most of the platform’s features from day one.

Understanding Your Income and Expenses

Before embarking on the process of budgeting, gaining a comprehensive understanding of your financial situation is paramount. The first step is to accurately calculate your total income, which includes all sources of revenue such as salary, rental income, and any freelance earnings. You can easily track this information by logging into gomyfinance.com, where you can consolidate all your income data in one place. This clear overview will enable users to establish a foundational understanding of their financial inflow.

Once you have a clear understanding of your income, it is equally important to track your expenses. Your expenditures can be categorized into two primary types: fixed and variable expenses. Fixed expenditures are those that remain constant each month, such as rent or mortgage payments, insurance premiums, and loan repayments. Variable expenses, on the other hand, can fluctuate, including costs such as groceries, dining out, and entertainment. By separating these two categories on gomyfinance.com, users can better comprehend where their money goes each month.

The platform also offers tools to help monitor and categorize these expenses automatically, making it easier for users to keep a close eye on their spending habits. It is advisable to take a month-long period to track all expenses meticulously. This practice will reveal patterns in your spending behavior, which can be insightful when formulating a budget. With a detailed view of both your income and expenses, you can now have the requisite knowledge to create a budget tailored to your financial goals. Utilizing gomyfinance.com for this process will streamline your financial management, making it more efficient and effective.

Setting Financial Goals

Establishing clear financial goals is an essential first step in the budgeting process. By defining both short-term and long-term objectives, individuals can better tailor their financial plans to meet their specific needs. Short-term goals may include saving for a vacation, building an emergency fund, or paying off high-interest debt, while long-term goals often encompass saving for retirement, purchasing a home, or funding education. Utilizing a platform like gomyfinance.com can significantly enhance this goal-setting process by providing users with the tools necessary to clarify their aspirations and keep them on track.

When setting financial goals, it is important that they are SMART—specific, measurable, achievable, relevant, and time-bound. For instance, rather than simply stating a desire to save money, a more effective goal would be “save $5,000 for a vacation by December next year.” gomyfinance.com enables users to set such detailed goals, helping them to visualize their financial journey. This structured approach is beneficial as it fosters motivation and commitment as users can monitor their progress effectively.

Moreover, gomyfinance.com offers various features that aid users in tracking their financial goals. Through customizable budget templates and online calculators, individuals can observe how their daily spending impacts their overall financial objectives. This allows them to make informed adjustments to their budgets, promoting accountability and long-term success. Importantly, the platform keeps users engaged through reminders and progress updates, reinforcing the emotional connection to their financial ambitions.

In conclusion, setting financial goals is a critical aspect of creating a budget. gomyfinance.com provides valuable resources that assist in defining these objectives and tracking one’s progress toward achieving them, ultimately leading to greater financial stability and personal satisfaction.

Creating Your Budget on gomyfinance.com

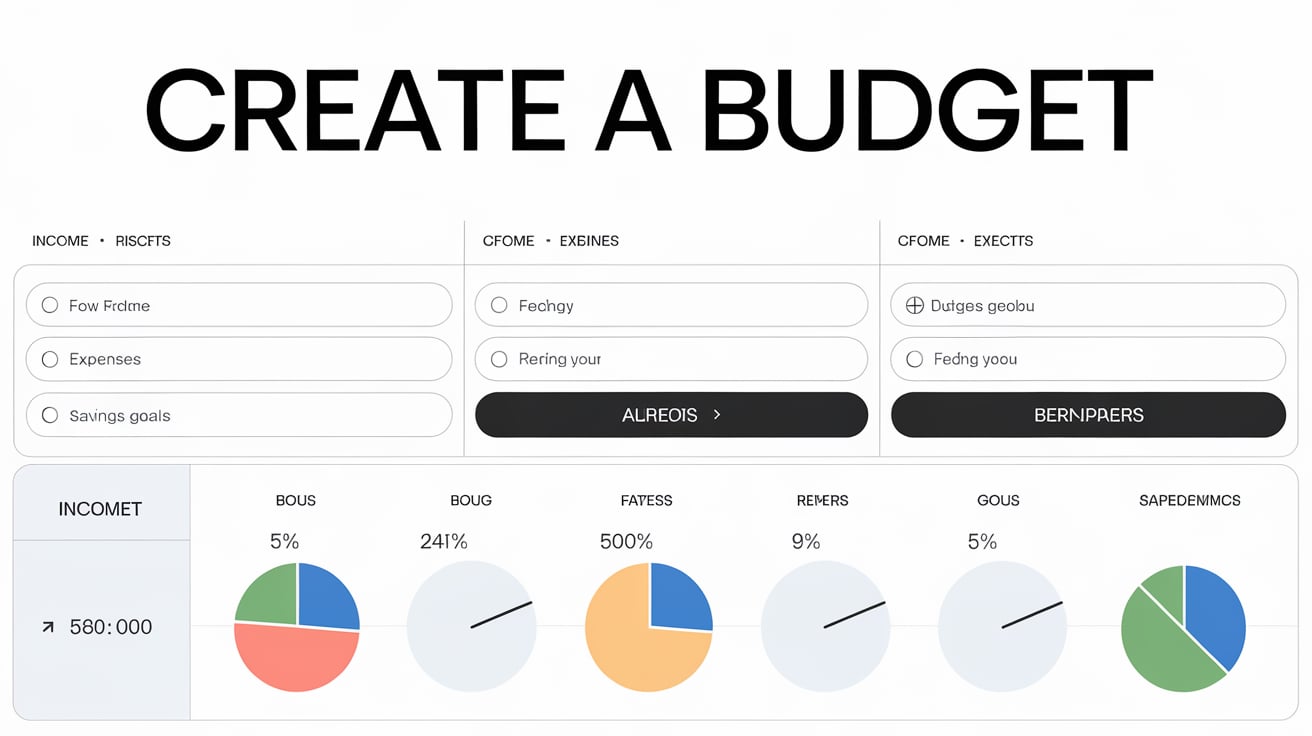

Creating a budget using gomyfinance.com is a systematic process that can streamline your financial management. The platform provides an intuitive interface to assist users in forming a personalized budget that aligns with their financial goals. To begin, users need to access the dedicated budget tool available on the site. Upon logging in, you will find a user-friendly option clearly labeled for budget creation.

Next, you will need to input your monthly income. This could include salaries, bonuses, or any side income streams. Ensure that the figures are as accurate as possible, as this will form the foundation of your budget on gomyfinance.com. Once your income is recorded, the next step is to allocate your expenses. The platform offers categories for essential expenses such as housing, utilities, groceries, and transportation, as well as discretionary spending like entertainment and dining out. You can adjust these categories according to your own personal financial situation.

As you input these values, the tool provides a visual representation of your budget, making it easier to understand where your money will go each month. Customization is a significant feature of gomyfinance.com, which allows users to tweak categories and amounts as necessary. This flexibility is crucial in creating a realistic budget that not only meets your financial objectives but also adapts to changes in your circumstances.

To further enhance the budgeting experience, consider setting aside a small percentage of your income for savings or unexpected expenses. This not only helps secure your financial future but also provides a buffer against unplanned costs. Overall, by utilizing the features available on gomyfinance.com, you can effectively create a robust and personalized budget, paving the way to better financial management.

Monitoring and Adjusting Your Budget

Creating a budget is not a one-time event, but rather an ongoing process that requires continuous attention and adjustment. Using gomyfinance.com create budget feature, individuals can effectively monitor their spending habits and make necessary modifications as financial situations change. To ensure you stay on track with your financial goals, regular usage of gomyfinance.com will allow you to keep an accurate record of your expenditures and income.

One key aspect of budget management is recognizing patterns in your spending. gomyfinance.com provides useful tools to categorize expenses and visualize them in reports. By analyzing your spending categories, you may notice trends such as overspending in dining out or entertainment. This data-driven insight is essential for making informed decisions about where to cut back if you find yourself consistently exceeding your budget in specific areas.

As life circumstances can change suddenly, from unexpected expenses to income fluctuations, your budget should be flexible enough to accommodate these shifts. gomyfinance.com enables users to adjust their budgets seamlessly. If you anticipate an increase in utility bills or a drop in salary, you can easily modify your budget to reflect these changes. Allocating funds to emergency savings may also become necessary, which the platform allows for with its customizable budgeting options.

Another effective strategy for monitoring your budget is setting specific financial goals. Utilizing gomyfinance.com create budget feature, you can establish savings targets for short-term and long-term objectives. By regularly reviewing your progress against these goals, you can ensure that your budgeting strategy is aligned with your overall financial health.

In summary, actively monitoring your budget through gomyfinance.com is essential for successful financial management. Recognizing overspending patterns and making real-time adjustments can enhance your budgeting experience, allowing you to achieve your financial objectives effectively.

Leveraging gomyfinance.com Features for Budgeting Success

gomyfinance.com is a robust platform designed to streamline the process of budgeting, ensuring that users can easily create and manage their finances with confidence. Among its most beneficial features are notifications and reminders, which serve as essential tools to keep individuals on track with their budgeting goals. These features remind users of upcoming expenses, bill payments, and budget limits, promoting accountability and encouraging consistent financial management.

Notifications are customizable, allowing users to select the frequency and type of reminders that best suit their needs. Whether it’s a weekly alert about an upcoming bill or a monthly reminder to review spending limits, these timely prompts help users stay engaged with their budgeting strategy. Consequently, users can proactively address any potential overspending before it becomes problematic.

In addition to notifications, gomyfinance.com provides comprehensive reporting tools that allow users to visualize their financial data. These reports can showcase spending habits over time, categorize expenditures, and highlight areas where users can make adjustments. By analyzing these insights, individuals can create budget strategies that align with their financial objectives, ensuring a more informed approach to their finances.

Moreover, the platform’s intuitive user interface simplifies interaction with the budgeting features. Users can easily access their financial reports and adjust their budgets on the fly, making real-time adjustments that reflect their changing circumstances. This flexibility is critical for individuals who may experience income fluctuations or unexpected expenditures.

Ultimately, by leveraging the features available at gomyfinance.com, users are not just creating a budget; they are establishing a sustainable financial plan. The combination of timely notifications, insightful reporting tools, and user-friendly design enhances the overall budgeting experience, promoting better financial health and stability.

Common Budgeting Mistakes and How to Avoid Them

Creating a budget is an essential step towards financial stability and efficiently managing one’s finances. However, many individuals encounter common pitfalls that can undermine their budgeting efforts. This discussion delves into these frequent mistakes and offers practical tips for avoiding them while using tools like gomyfinance.com to create a budget.

One prevalent error is the underestimation of expenses. Many budgeters fail to account for irregular costs, such as annual subscriptions or sporadic medical bills, leading to a disconnect between their budget and actual financial activity. To overcome this issue, it is advisable to review past spending habits for a more accurate picture of anticipated costs. Utilizing gomyfinance.com can facilitate this process, as the platform allows users to track expenses over time, enabling a comprehensive view of spending patterns.

Another common mistake is neglecting savings. Often, individuals focus narrowly on meeting monthly bills and overlook the necessity of setting aside funds for future goals or emergencies. It is crucial to incorporate savings into the budget as a fixed line item, rather than viewing it as an afterthought. gomyfinance.com helps automate the savings process by enabling users to outline savings goals and monitor progress, ensuring that setting aside money becomes a priority rather than an afterthought.

Additionally, many people misuse budgeting tools. It is easy to become overwhelmed by the various features available on platforms like gomyfinance.com. To maximize effectiveness, users should familiarize themselves with the core functionalities of the site to ensure that it serves their specific needs and preferences. This targeted approach can help prevent frustration and promote consistent engagement with the budgeting process.

Being aware of these common budgeting mistakes is the first step toward achieving financial clarity and stability. By carefully considering expenses, prioritizing savings, and effectively using gomyfinance.com to create a budget, individuals can make informed financial decisions that align with their long-term goals.

Conclusion: Achieving Financial Freedom with gomyfinance.com

As we reflect on the essential steps outlined in this guide, it becomes clear that creating a budget is a fundamental aspect of attaining financial stability and ultimately achieving financial freedom. The platform gomyfinance.com provides users with the necessary tools and resources to establish a well-structured budget tailored to individual needs. By following the outlined steps, you have learned how to assess your income and expenses, set realistic goals, and track your progress over time.

Consistent budgeting is not merely about restricting your spending; it serves as a roadmap that allows you to allocate funds effectively and prioritize financial goals. Utilizing gomyfinance.com to create a budget means taking a proactive approach to manage your finances. The platform aids users by providing insights into spending habits, facilitating easy tracking of your budget, and creating a supportive environment for achieving financial wellness.

The empowerment gained through utilizing gomyfinance.com extends beyond just immediate financial organization. It encourages a mindset shift, promoting ongoing engagement with financial planning. As you regularly revisit and refine your budget, you foster a deeper understanding of your financial situation and make informed decisions that align with your long-term aspirations.

In conclusion, the journey to financial freedom is a continuous process that begins with making informed choices today. By leveraging the intuitive features of gomyfinance.com, you can create a budget that evolves with you, adapts to your changing circumstances, and ultimately supports your pursuit of financial independence. Embrace this opportunity, and pave the way toward a secure and prosperous financial future.

You May Also Read This Usadigital.